Sustainability Assurance

Introduction

Sustainability has become an essential component of business models, influenced by global trends such as increased connectivity, climate change, and urbanization. Environmental and social risks are consistently ranked among the most critical risks for businesses, economies, and countries globally. Stakeholders now demand more than mere compliance, seeking proactive and meaningful efforts toward sustainability. Organizations are under growing pressure to manage these risks, driven by new regulations and standards, stakeholder expectations, and market dynamics.

Sustainability assurance aligns organizational strategy and operations with the goal of creating integrated corporate and societal value. Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) serve as valuable tools for collecting data, measuring progress, and assessing a organization's contribution to global sustainable development. These mechanisms enable companies and organizations to measure their performance across all dimensions of sustainability, set ambitious goals, and facilitate the transition to a low-carbon, resource-efficient, and inclusive green economy.

Analogy between Sustainability, ESG, and CSR

Sustainability encompasses both ESG and CSR, integrating social, economic, and environmental aspects of responsible business practices. ESG and CSR represent different approaches to demonstrating a commitment to sustainability: CSR offers an idealistic, big-picture view, while ESG provides a practical, detail-oriented framework.

CSR can be considered the precursor to ESG, where companies voluntarily take initiatives to contribute to society beyond their economic goals. ESG, in turn, involves specific criteria to evaluate a company's performance in environmental, social, and governance areas. Together, these frameworks highlight the importance of sustainable practices for long-term financial performance. Companies self-regulate to adopt sustainable practices, aiming to positively impact society. CSR strategies can be refined and measured against ESG metrics, with ESG reports publicly disclosing the data. This process adds quantifiable credibility to the broad management philosophy of CSR, reinforcing the need for both practices to achieve true sustainability.

|

Sustainability |

ESG |

CSR |

|

Qualitative and Quantitative |

Quantitative |

Qualitative |

|

Self and Externally Regulated |

Externally Regulated |

Self-Regulated |

|

Often related to Business Valuation |

Directly related to Business Valuation |

Not directly related to Business Valuation |

|

Implemented through a combination of ESG and CSR |

Implemented through measurable Goals and Audits |

Implemented through Corporate Culture, Values and Brand Management |

Sustainability Frameworks and Standards

According to the SASB Standards, sustainability frameworks provide principles-based guidance on structuring information, preparing reports, and covering broad topics. In contrast, standards provide specific, detailed, and repeatable requirements for reporting on each topic, including relevant metrics. These standards are designed to ensure that ESG disclosures within a given framework are consistent and comparable.

Global Scenario

- ISO 26000:2010: Guidance on social responsibility

- ISO 32210: Sustainable finance – Guidance on the application of sustainability principles for organizations in the financial sector

- ISO 14030-1: Green Debt instruments – Part 1: process for green bonds

- ISO/CD 14019: Validation and verification of sustainability information -- Part 1: General principles and requirements

- ISO/CD 14019: Validation and verification of sustainability information -- Part 2: Verification process

- International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards

- Sustainability Accounting Standards Board (SASB) Standards

- Global Reporting Initiative (GRI) Standards

- European Union - Corporate Sustainability Reporting Directive

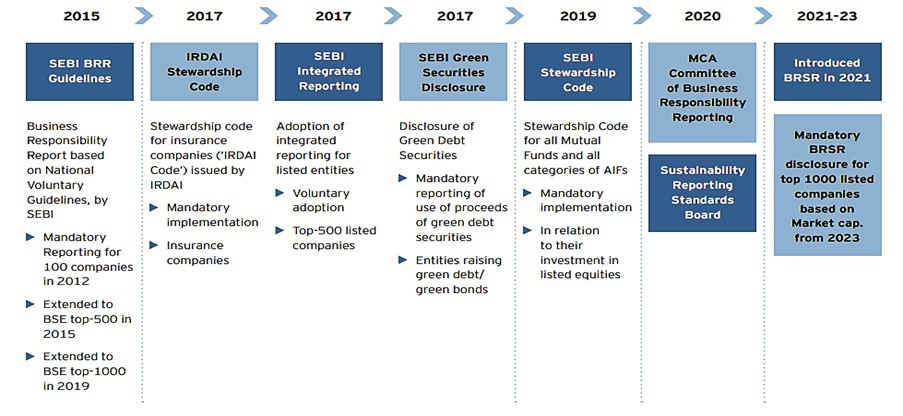

Indian Scenario

Need for Conformity Assessment

In recent years, there has been a rapid increase in the demand for accurate, reliable, and credible non-financial information to help organizational stakeholders, such as investors, banks, and consumers, make informed decisions about risks and adverse impacts related to non-financial aspects. Regulatory authorities and standardization bodies have intensified the needs by developing mandatory rules and voluntary standards aimed at introducing stringent criteria for all aspects of sustainability.

According to ISO/IEC 17029, sustainability reporting and ESG ratings are claims that require standardized processes for reliable validation and verification. Current challenges in this area include incomplete evaluation criteria, poor compliance with international standards, a lack of criteria to demonstrate the competence of evaluators, non-standardized evaluation procedures, unreliable mechanisms to ensure impartiality and prevent conflicts of interest, and insufficient controls on bodies issuing ESG labels, certifications, and ratings.

To ensure robust assessments that provide accurate and reliable sustainability information, it is essential to have reliable protocols for external assurance, verifiers with demonstrated competencies, and assurance processes monitored by third-party authorities to guarantee the credibility of the entire process.

Business Prospects

- Verification of the claims on ESG performance and CSR activities disclosed by the companies under Business Responsibility and Sustainability Reporting (BRSR) framework and the Companies Act, 2013 respectively.

- Providing validation and verification services based on the requirements of global standards such as GRI (Global Reporting Initiative), SASB (Sustainability Accounting Standards Board), and TCFD (Task Force on Climate-related Financial Disclosures) can enhance service offerings.

- Promote the use of accredited conformity assessment for regulatory and voluntary CSR and ESG verification, Reporting and Rating to improve trust and confidence of such services and improve competence, impartiality, consistency, and mutual recognition.

- Offering training programs and workshops on ESG and CSR reporting standards.

- Validation and Verification for NetZero and Carbon Credits claims for potential industry sectors such as Power Generation, General Manufacturing, Oil and Gas, Energy, Chemical, Mining, Transport, Waste Handling and Disposal, Agriculture, Construction etc.